Huawei Cloud introduced its Cloud Native Core Banking solution – the foundation for agile innovation of traditional banks and new digital banks, at the Huawei Intelligent Finance Summit 2022 and shared three trends of digital transformation in the financial industry. First, all-cloud, meaning financial organizations migrate to the cloud, starting from peripheral systems and then core systems. Second, big data and AI convergence, which ushers in a new era of intelligent governance to leverage data as assets for maximized value. Third, all-scenario intelligent connection, where the physical and virtual worlds merge to create experience-centric, inclusive finance.

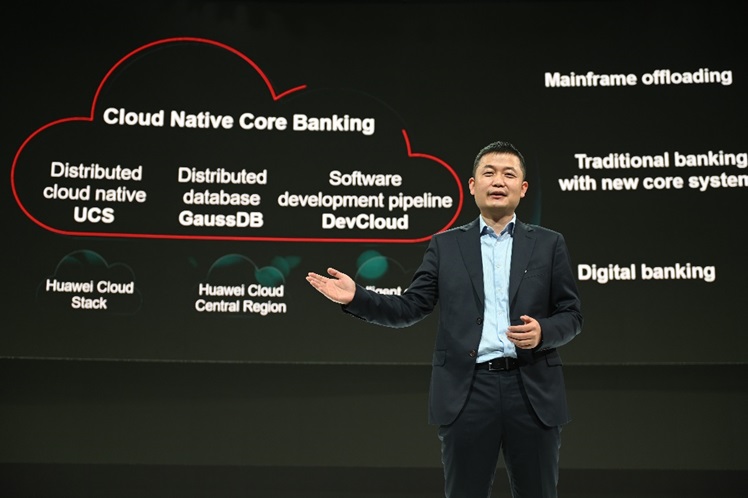

William Dong, President of Huawei Cloud Marketing, said in his keynote speech, “Currently, digital transformation is deepening across global financial institutions. This presents an era of opportunities for financial organizations to make the leap, take the lead. Finance will eventually become smart, all-scenario, and inclusive, readily accessible for everyone in diversified forms. Huawei Cloud will work with our partners to keep abreast of these three trends, and build Everything as a Service for smart finance in every scenario.”

Fully Embrace the Cloud and Move Core Systems to Distributed Cloud Native

At the summit, Huawei Cloud launched Cloud Native Core Banking solution to provide a stable cloud native platform for offloading mainframes, building new core systems for traditional banks, and powering digital banks. Cloud Native Core Banking includes three core services: Ubiquitous Cloud Native Service (UCS), or Huawei Cloud’s distributed cloud native service, in conjunction with the GaussDB(for openGauss) distributed database and DevCloud software development pipeline. The solution features high availability, large-scale concurrency, and agile application iteration. A demonstration of its high availability is a disaster recovery (DR) of RPO = 0 for RTO ≤ 2 minutes.

Postal Savings Bank of China has built a new-generation distributed core system on Huawei Cloud to support massive transactions, elastic scaling, and financial-grade reliability and HA. The system processes 2 billion transactions per day for its 637 million customers and 40,000 branches. The Green Link Digital Bank has built more than 20 core and peripheral systems on Huawei Cloud, shortening service rollout to 3 days. With the help of Huawei Cloud and partners such as Temenos, the bank completed compliance certification and service rollout within 11 months as required for its rapid business development.

Big Data and AI Convergence

Finance is a highly digital industry that takes the lead in converging big data and AI.

To fully unlock data value, Huawei Cloud provides a big data and AI convergence platform to solve governance problems caused by data silos between lakes, warehouses, and AI platforms. Huawei Cloud provides capabilities such as unified storage and metadata, so that a copy of data can be transferred between multiple engines quickly and consistently. Industrial and Commercial Bank of China (ICBC) started data analysis and exploration on this convergence platform and greatly improved its efficiency, with average data query wait times reduced from 300 minutes to 1.5 minutes.

In addition, Huawei Cloud works with partners to launch smart process robots, integrating AI, robotic process automation (RPA), and low-code capabilities. Intelligent automation greatly improves the processing efficiency of frequent financial services.

In addition, Huawei Cloud launched the Pangu graph model, which uses groundbreaking graph network fusion to improve the accuracy of financial exception identification to 90%, spotting financial exceptions in minutes and greatly enhancing enterprise risk identification.

Merging the Physical and Virtual Worlds for All-Scenario Intelligent Connection

This January, the People’s Bank of China (PBOC) released its Fintech Development Plan for 2022-2025, which seeks to infuse digital into financial, building a digital mindset for the whole business link. Against this backdrop, multiple banks have launched virtual human employees for customer service and image endorsement.

This year, Huawei Cloud launched the MetaStudio digital content pipeline, lowering the barriers to use virtual human services for industries. MetaStudio includes services such as virtual human generation, generating 3D avatars for users in just 5 seconds using an uploaded photo; virtual livestreamers for users to drive 3D virtual humans in real time using a single camera without professional face or motion capture devices, at a latency less than 100 ms; and virtual human video generation so users need only enter text to produce an AI-driven presentation video, which is suitable for customer service, course presentation, and news hosting.

Working with Customers and Partners to Build Smart Finance for Every Scenario

Huawei Cloud builds trusted and innovative cloud services for finance customers in the Asia-Pacific. Zeng Xingyun, President of Huawei Cloud APAC, said that in terms of industry strategy, Huawei Cloud will focus on “Infrastructure as a Service, Technology as a Service, and win-win with cloud ecosystem partners” to continuously improve the core competitiveness of Huawei Cloud. In terms of market strategy, Huawei Cloud will focus on in-depth digital transformation, financial-grade security and compliance, and the best ToB services to continuously create value for customers and partners.

Huawei Cloud has served the digital transformation journey of more than 300 financial customers worldwide, including banks, insurance companies, securities companies, and fintech companies. In the future, Huawei Cloud will work with customers and partners around the world to build smart finance for every scenario.

Caption – William Dong delivering the speech Huawei Cloud: Everything as a Service for Smart Finance